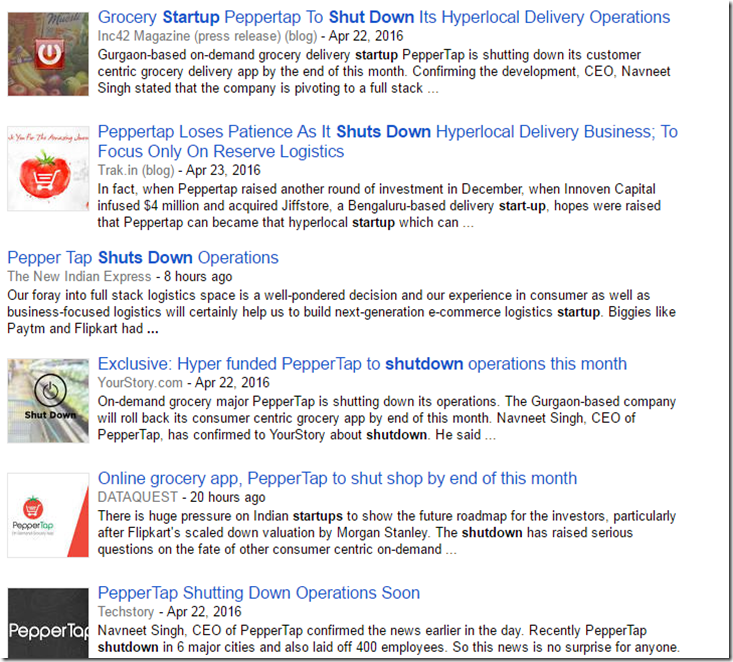

Early April, a journey that started in thea summer of 2014, was about to end. Co-founders Navneet Singh and Milind Sharma decided to shut down PepperTap, India’s third largest e-grocer. They didn’t have an option.

PepperTap was losing money on every order due to discounts, which went as high as 70%, and there were no signs of profitability or more funding.

“Who will give $100 million? The investment climate has changed from what it was a year back. There is no visibility on the next round of funding,” Singh told HT, adding that PepperTap didn’t even look for more money. Not even from Snapdeal, which led PepperTap’s last funding round of $40 million (`260 crore) and hoped to integrate the business.

PepperTap wanted to revolutionise grocery buying – freedom from queues, no parking hassles and no haggling. It was simple— create a marketplace for people to order food online and Singh’s foot soldiers would collect the goods and deliver it within two hours. The plan, however, did not work to script (see box).

Singh could have moved to an inventory-led model from the marketplace model, which works well on scale and requires a lot of money, according to Singh.

Vipul Parekh, co-founder of BigBasket, thinks the other way. “Grocery can only be done if it is inventory-led,” Parekh had told HT earlier. Grofers, too, has shifted to an inventory-led model. Grofers has raised $120 million and Big Basket $150 million in their latest funding rounds.

Some companies, meanwhile, have adopted a tweaked marketplace model. Zip.in, a hyperlocal marketplace in Hyderabad, accumulates orders before noon, purchases them from wholesalers and delivers them later. “Aggregating orders gives us better margins,” said Kishore Ganji, CEO of Zip.in.

Before PepperTap, LocalBanya, Flipkart, Paytm and Ola Cabs have closed their e-groceries. However, Morgan Stanley estimates the sector can grow to $19 billion (`1.25 lakh crore) by 2020, smaller than only electronics and apparels. The report also cements BigBasket’s business model: “BigBasket turns inventory 40 times per year versus 7-8 times for an offline player and has 97.3% on-time delivery.”

Meanwhile, Singh has “a significant amount of money” from the last funding round in the bank. He will use it to build his new logistics venture. But, Snapdeal will have to find a new partner for its grocery dream.