TinyOwl, a Mumbai-based food technology start-up, is staring down the barrel of a gun.

The numbers tell the dismal story. Burning through Rs 2.5 crore a month on an average, it was only left with Rs 18 crore at the end of January. In the past 18-odd months, it had raised Rs 152 crore from various marquee investors and has now run out of options.

No investor is keen on funding the company, and no one wants to buy it. So, it has until June for its final hurrah - unless it can get funding or sell.

But how did the blue-eyed child of the start-up ecosystem get here?

The slide started in September 2015 when it fired 300 employees after over-hiring - a common mistake for start-ups.

The cracks were obvious when one of the employees, in her 30s, took a deep breath, composed herself and marched into a cabin, threw open the door and announced herself in a loud voice.

"How much money did you save when you fired me?" she asked Harshvardhan Mandad, the founder and chief executive officer of TinyOwl.

Mandad stared back, followed by moments of silence. "You know what? I don't care and neither do you," she said and marched out.

As the door closed, onlookers say Mandad was back to looking at his phone, as if nothing had happened.

It was one of those rare moments when Mandad was actually in the office. The IIT-B alumnus' primary job is fund raising. Operations, finance, marketing, human resource and technology are the jobs that are split between the other four co-founders - Shikhar Paliwal, Gaurav Choudhary, Tanuj Khandelwal and Saurabh Goyal.

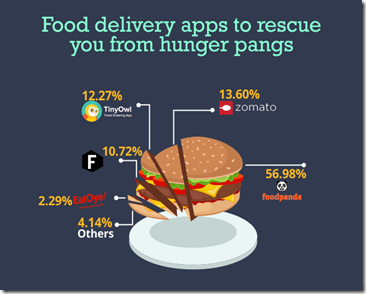

The woman was one of those hired, interviewed personally by Mandad, after the company peaked at 2,500 orders in July 2015. The founders and investors were excited. For context, here's an example: India's biggest food tech brand, Zomato, does about 3,000 orders a day now.

The uncoordinated hiring, and subsequent retrenchment, meant TinyOwl's burn skyrocketed to Rs 8-10 crore a month. The discount game meant most customers kept coming back but there were no loyalties.

Money was running out.

Mandad approached investors from across the world. A few Germans were flown in. Everyone refused. Mandad then started approaching competitors to buy out a portion of the company in October.

Business Standard, at the time, had sent an email asking if the company was on the block. Mandad and Gautam Mago from Sequoia Capital, the company's lead investor, said no.

"Oh yes. Harsh approached everyone he could,'' said a former employee who was part of the "inner circle".

Sequoia, Nexus Venture Partners and Matrix Partners agreed to give the company Rs 52 crore but that was it, they said.

Make it last 12 months, the investors are learnt to have told the company.

TinyOwl had gotten a second lease of life. But how would Rs 50 crore or last 12 months when the burn rate was Rs 10 crore a month?

That is when TinyOwl made its second mistake.

In November 2015, it initiated a second round of cuts. Mandad was advised not to retrench so close to Diwali. But the cuts were announced.

Only the Mumbai and Bengaluru divisions were kept alive. The co-founders were sent to various locations. The hostage drama and the breakdown in the relationships between the employees and the founders are well documented.

Where was Mandad? No one is sure. Through the meltdown, he did not come to work. He communicated only through his phone.

The burn was now down to under Rs 4 crore. The money would last seven months, give or take.

But the orders, thanks to the bad press, were down to only 1,000 a day and TinyOwl wasn't discounting any more. Swiggy had taken over from TinyOwl.

Sources at Bengaluru-based Swiggy said they are currently processing more orders than Zomato.

That is when TinyOwl committed its third mistake.

In the first week of December, Mandad announced to his team that the company was going to launch a new version of TinyOwl. "Everyone was caught off-guard," recalls a former employee.

It was now going to do a dish-based aggregation system. If you open the app, it will tell you the dish for today is dosa.

The app would then give you options of where you could order from.

"There was hardly any artificial intelligence used. There was no data analytics," said an employee who helped develop the system. The listing business was to go on but the focus would be dishes. The pivot tanked with just about three orders a day as of two months ago.

Then, just before Mandad went on a three-week break in December, he made mistake number four - he hired a chief technology officer. Akash Saxena is learnt to have joined as CTO at Rs 1.5 crore a year and a joining bonus of Rs 50 lakh.

The investors, who had so far been hands off, were counting every penny now. So, around 10 from the tech team got fired, to convince investors that cost had not risen, said another employee.

At its peak, the tech team had 200, working on just the app. Now, it has 20. The total staff strength - once 1,100 - is now under 200. This is when Mandad remotely asked the Bengaluru office to be shut down. When Mandad returned in January he began preparation for mistake number five.

He started discussing another pivot: an area-based food aggregation, similar to what Grofers runs in grocery.

"In this, let's assume, you ordered roti, sabzi and dal. TinyOwl would get all three from different restaurants and deliver it to you," said an employee who recently quit. He had raised serious doubts over the scalability of the model.

In this business model, TinyOwl had to pay for the logistics of gathering the food from various restaurants. It would cost TinyOwl dear.

For the area-based food aggregation plan, more cash was required and all head of the departments were told to find new jobs.

"We asked him (Mandad) to make Homemade (TinyOwl's amateur chef aggregation business) the key focus. The only competitor was HolaChef and we could take them on," an employee said. Instead, Homemade, the only arm of TinyOwl that breaks even, was dissolved. That's mistake number six. Mandad and the investors initiated a valuation audit, which confirmed that the company was on sale. The hope, among the founders, is that the company will be absorbed by Zomato as Sequoia is a common investor. A few former employees said that Mandad had hinted Ola may be interested as well.

But these talks, too, failed. Reports emerged that TInyOwl maybe in talks with Roadrunnr in an all-stock deal. But the reports could not be confirmed.

Zomato refused to comment on the reports that TinyOwl had approached them looking for a buyout. Emails sent to TinyOwl, Ola and Roadrunnr did not elicit a response.